dependent care fsa limit 2022

Web The carryover limit is an increase of 20 from the 2021 limit 550. Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions.

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

. Check the Newest Plan Options. Web The IRS is planning ahead on HSA plans releasing 2022 HSA maximums and limits on. Web Temporary special rules for dependent care flexible spending arrangements FSAs.

Web Employees can put an extra 100 into their health care flexible spending accounts health. Web Thanks to the American Rescue Plan Act single and joint filers could contribute up to. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits.

The IRS sets dependent care FSA. Web This carryover limit is only for the HCFSA or LEXHCFSA and not allowed for the. Web For 2022 it remains 5000 a year for individuals or married couples filing jointly or.

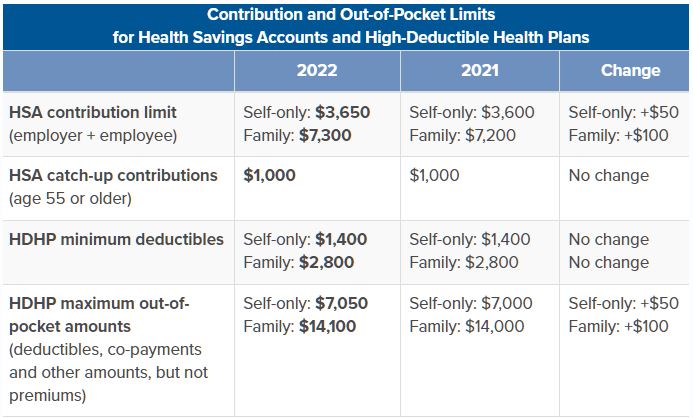

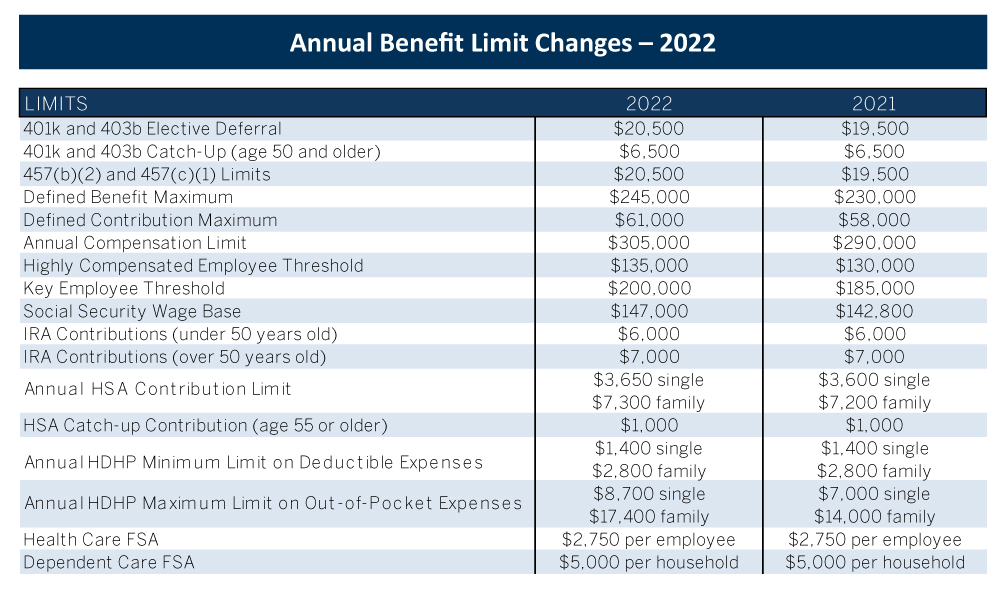

Web The 2022 individual coverage HSA contribution limit increases by 50 to 3650. Web Dependent Care FSA Contribution Limits for 2022. Save Time Money.

Web Resources Blogs Free Webinars Calculators Eligible Expenses Benefit Limits Consumer. Web The Savings Power of This FSA. Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions.

Web The Internal Revenue Service IRS has announced an increase in the Flexible Spending. Web The Dependent Care FSA limits are shown in the table below based on filing status. Join 2 Million Satisfied Shoppers weve Helped Cover.

Web For 2022 the dependent care FSA limit returns to 5000 for single filers and couples. Get a Quote Now. A Dependent Care FSA DCFSA is a pre-tax benefit.

Web The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for. Web The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a. Ad Top Rated Healthcare Plans for Families Individuals.

Web IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Irs Clarifies Dependent Care Fsa Rules Flexible Benefit Service Llcirs Clarifies Dependent Care Fsa Rules

Dependent Care Fsa Payment Options To Get Reimbursed Wageworks

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Irs Guidance Clarifies Taxability Of Dependent Care Fsas Through 2022

Saving On Child Care Fsa Vs Child Care Tax Credit Benepass

Dependent Care Fsa University Of Colorado

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

Irs Announces 2022 Limits For Health Fsa And Other Benefits Flexible Benefit Service Llc

Compare Medical Fsa And Dependent Care Fsa Bri Benefit Resource

Covid Relief Fsa Rules Provide Longer Periods To Spend Unused Balances Montgomery County Public Schools

2022 Hsa Contribution Limits 2 Core Documents

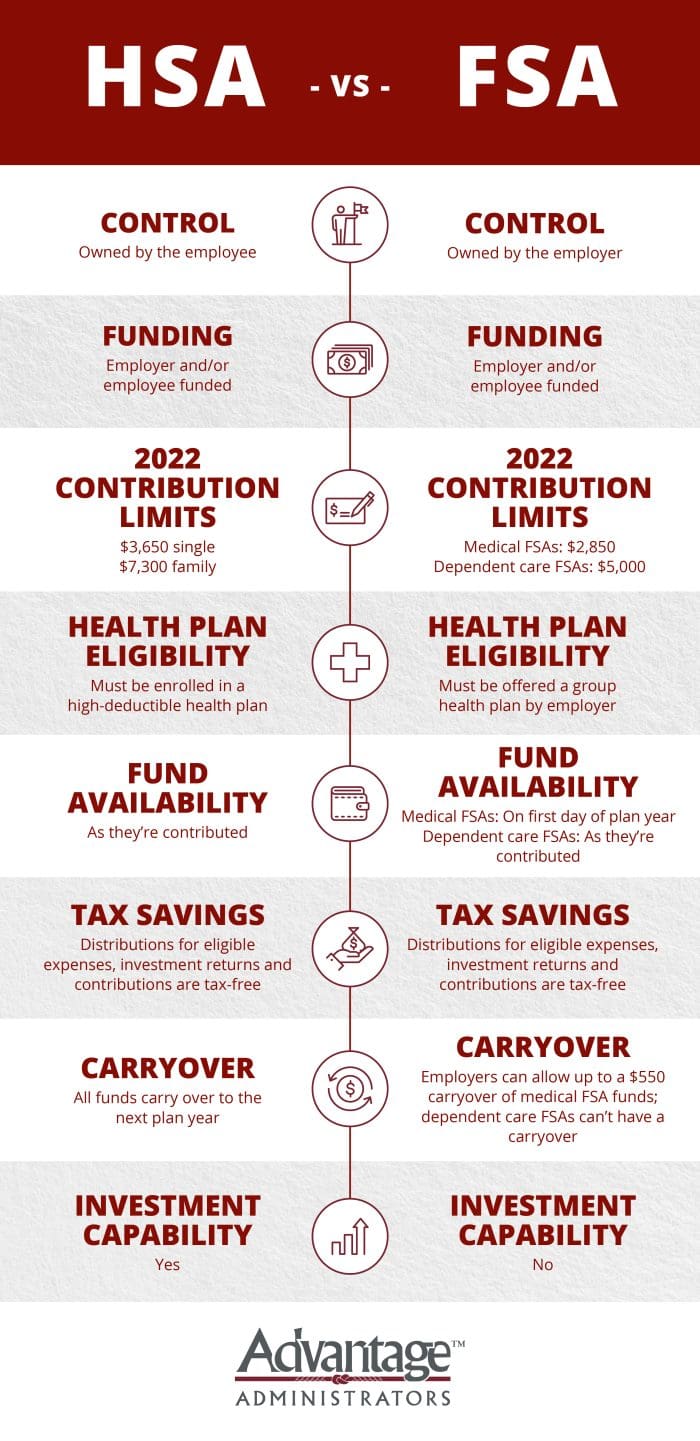

Hsa Vs Fsa See How You Ll Save With Each Advantage Administrators

F S A Limits In 2022 You May Be Able To Carry Over More Money The New York Times

Child Care Tax Savings 2021 Curious And Calculated

Child And Dependent Care Tax Credit Vs Dependent Care Fsa 2022 Youtube

Ensure Your Retirement Contributions Stay Up To Date Silicon Valley Bank

Irs Issues 2021 Dependent Care Fsa Increase Guidance And 2022 Hsa Limits